Do Otc Bitcoin Traders Need To Register With Fincen

Major Trends and Developments

$3.5 Billion Sent from Criminal BTC Addresses in 2020

One US Exchange Sent More than $36.7 Million Directly to Criminals in 2020

US Exchanges Sent $41.2 Million Directly to Criminals

Over Half of 2020 Crypto Hacks are from DeFi Protocols

DeFi Rug Pulls Emerge as Top Exit Scam

Future of DeFi Hacks, Scams, and Regulation

FinCEN's Proposed Rulemaking Creates New Reporting and Record-Keeping Requirements for Transactions to Unhosted Wallets

US "Travel Rule" Rule Making's Lower Threshold Could Double the Compliance Triggers for VASPs

Over One Third of Cross-Border Bitcoin Volume is Sent to Exchanges with Demonstrably Weak KYC

Exchanges Receive Over Half of BTC Payments in 2020

Percentage BTC Volume Sent to High-Risk Exchanges Reaches All-Time Low

Terrorist Use of Cryptocurrency in 2020

DOJ Seizures of Cryptocurrency Donations Puts a $2 Million Hole in Terrorist Finances

French Police Arrest Twenty-Nine in Cryptocurrency Terrorism Financing Scheme

Major Enforcement Actions

BitMEX Executives Charged with Illegal Operations and Anti-Money Laundering Violations

Ripple, Execs Face SEC Lawsuit

FinCEN Fines Operator of Helix Mixer $60M for Bitcoin Laundering Scheme Linked to Notorious Dark Markets

BitGo Enters Into $98,830 Settlement with US Treasury Over Multiple Crypto Sanctions Violations

FBI and German Police Charge Operators of movie2k.to and Seize $30 Million in Crypto

US Attorney's Office Charges Man with Operating Unlicensed ATM Network

Fifteen Plead Guilty After Implication in International Crypto-Crime Ring

DOJ Charges Founder of "AML Bitcoin" with Money Laundering

SEC Orders Telegram to Return $1.2 Billion to Investors, Pay $18.5 Million Penalty to Settle Charges

Chinese Authorities Arrest Over 100 People for Involvement in the PlusToken Ponzi Scheme

US Prosecutors Attempt to Return $6.5 Million in Crypto to Victims of Ponzi Scam

Centra Tech Inc. Co-Founder Implicated in $25 Million Scam

$15 Million in Crypto and Supercars Seized as Chinese Police Bust Arbitrage Scam

Police Arrest BitGrail Boss for His Role in Largest Cyber-Financial Attack in Italy

Promoter of Australian Cryptocurrency Lending Scheme Sentenced to 20 Years

The US Department of Justice Seized $24 Million from a Brazilian Cryptocurrency Investment Scheme

IRS Calls Sentencing of Ukrainian National the First Case of Bitcoin Tax Fraud in US

OKEx Founder "Star" Xu is Being Held in Police Custody

Global Cryptocurrency Money-Laundering Cartel Busted—20 Arrested

Bitcoin Escrow Company CEO Pleads Guilty to Fraud and Embezzlement

Crypto Trader Charged with Fraud and Ordered to Repay Over $6 Million to Investors

Coincheck Hack Proceeds Seized in Japan's First Official Seizure of Cryptocurrency

Justice Department Charges Airbit Founders with Cryptocurrency Mining Fraud

Malaysian Authorities Arrest Crypto Miners That Stole $600K+ in Electricity

OCC Hits New York Based Bank with First-Ever Enforcement Action for Lack of Crypto AML Compliance

Major Thefts, Scams, and Fraud

Social Media Giant Twitter Compromised by Insiders

Cryptocurrency Exchange KuCoin's Hot Wallets Hacked for Millions

DeFi Hackers Use Complex Attack to Steal $500,000 From Balancer

Instagram Influencer "Hushpuppi" Hides $14 Million of Stolen Funds in Bitcoin

New Zealand Police Seize $90 Million in Investigation of BTC-e Exchange

Nexus Mutual CEO Hacked for Over $8 Million in NXM Tokens

$2.5 Million in Crypto Stolen Through SIM Card Hacks by Irish Man

Argentina's National Immigration Agency Hacked by Ransomware Group

Slovakian Crypto Exchange Eterbase Loses $1.6 Million in Hot Wallet Hack

Wotoken Ponzi Scheme Defrauds Investors of Over $1B Worth of Crypto

Changes in Global Regulatory Environment

Current Implementation of AML/CTF Regulations Globally

FATF—Revised Standards on Virtual Assets 12-Month Review

FATF—Virtual Assets Red Flag Indicators of Money Laundering and Terrorist Financing

EU—Crypto Businesses Faced with AMLD5 Regulation

US—FinCEN Releases New Proposed Rule Aimed at Closing AML Gaps from Unhosted Wallets

US—FinCEN, OFAC Warn VASPs of Potential Sanctions Violations for Allowing Customers to Pay Ransomware

US—National Defense Authorization Act for Fiscal Year 2021 (H.R.6395)

US—OCC Issues Statement Allowing Banks to Hold Crypto Assets for Customers

US—4th Amendment Does Not Protect Bitcoin Data, Says US Appeals Court

US—DOJ Publishes Cryptocurrency Enforcement Framework

UK—FCA Becomes AML and CTF Supervisor for UK Cryptoasset Activities

UK—FCA Issues Notice to UK Cryptoasset Businesses

UK—New National Risk Assessment of Money Laundering and Terrorist Financing

France—Mandatory KYC Rules for All Cryptocurrency Transactions on the Horizon

South Korea—New Tax Targets Crypto Traders

South Korea—Plans to Ban Privacy Coins

Kyrgyzstan—National Bank Developing New Cryptocurrency Laws

Pakistan—Creation of Crypto Framework in the Works

Central Bank Digital Currencies

BIS—Central Banks Reject Popular Narrative Regarding CBDC Issuance Motives

US—National Banks Can Use Stablecoins to Facilitate Payments, OCC Says

US—Federal Reserve Board Governor Announces Co-Op with MIT to Research Digital Currency

The Bahamas—Sand Dollar Sees Retail Use

China—Central Bank Digital Currencies Make Big Strides Forward

Sweden—Taking Next Step on CBDC Development

Australia—The CBDC Race Heats Up Down Under

Brazil—President of Central Bank Sees CBDCs as the Future of Finance

Private Sector—Citigroup Working with World Governments to Build CBDCs

IOSCO—Global Stablecoins May Be Subject to Securities Regulation

Sanctioned Countries

Russia

Iran

North Korea

Venezuela

Show Complete Table of Contents

Executive Summary

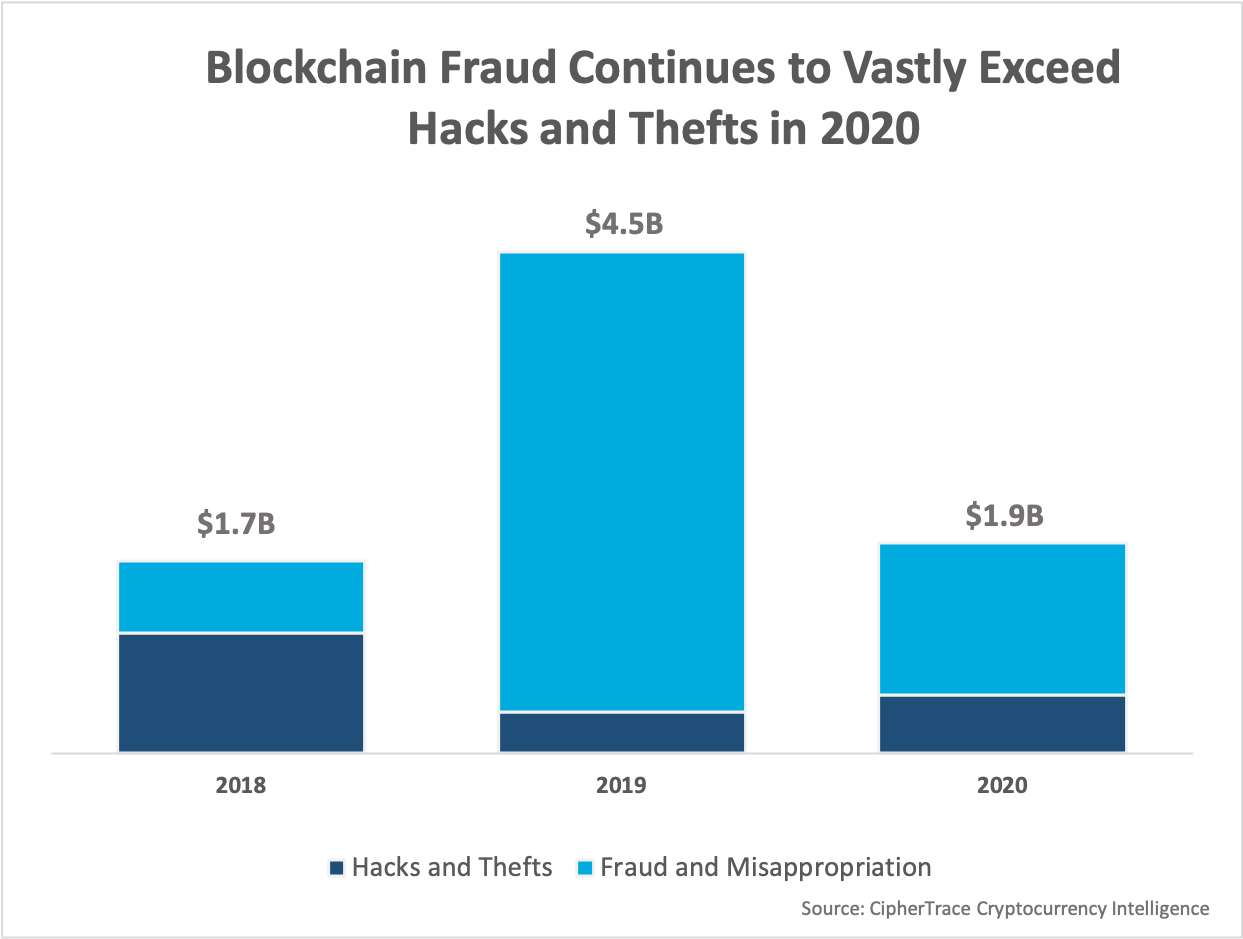

CipherTrace's 2020 Cryptocurrency Crime and Anti-Money Laundering Report reveals that in 2020, major crypto thefts, hacks, and frauds totaled $1.9 billion—the second-highest annual value in crypto crimes yet recorded.

Massive exit scams have dominated cryptocurrency crimes in the last two years. In 2019, the Ponzi scheme PlusToken netted $2.9 billion with its exit scam— 64% of the year's major crime volume. 2020 saw WoToken, a similar scheme operated by some of the same people as PlusToken, defraud investors out of $1.1 billion in its exit scam—58% of 2020's major crime volume. While major fraud volume saw a significant decrease, it still made up 73% of 2020's crime total.

While 2019 and 2020 saw a similar number of thefts, hacks, and fraud, the average value[1] taken by criminal actors in 2019 was 160% higher than in 2020, indicating maturity in the crypto space as entities continue to harden systems and take precautions against inside and outside threats. While 2020 did see a large $281 million hack of cryptocurrency exchange KuCoin, the exchange claims to have already recovered 84% of the stolen funds—something almost unheard of in previous years.

Another factor contributing to this discrepancy is that 2020 was overrun by dozens of DeFi related hacks and scams, which were much smaller in size. Half of all 2020 crypto hacks were of DeFi protocols—a pattern that was virtually negligible in all prior years—and nearly 99% of major fraud volume in the second half of 2020 stemmed from DeFi protocols performing "rug pulls" and other exit scams in a pattern eerily reminiscent of the

2017 ICO craze. In a rug pull, which is similar to a pump and dump, some investors will liquidate the entire DeFi pool, leaving the remaining token holders with no liquidity and unable to trade, wiping out the remaining value.

On the regulatory front, the cryptosphere has been inundated with new legal attention as regulatory and policy making bodies weigh in on how the space should operate. In the US, FinCEN has proposed two major rule changes to the regulatory obligations banks and virtual asset service providers (VASPs) face when conducting certain virtual currency transactions.

One notice of proposed rulemaking (NPRM) issued in October sought to amend the recordkeeping and Travel Rule regulations to collect, retain, and transmit transfer information on international payments at a much lower threshold. As it stands, financial institutions currently transmit records for any transfers in excess of $3000. The new rule would see much smaller transfers—anything over $250—come under the same requirements if the transmittal of funds begins or ends outside the United States. The rule specifically includes cryptocurrency transfers as a class of transactions to which the proposal would apply.

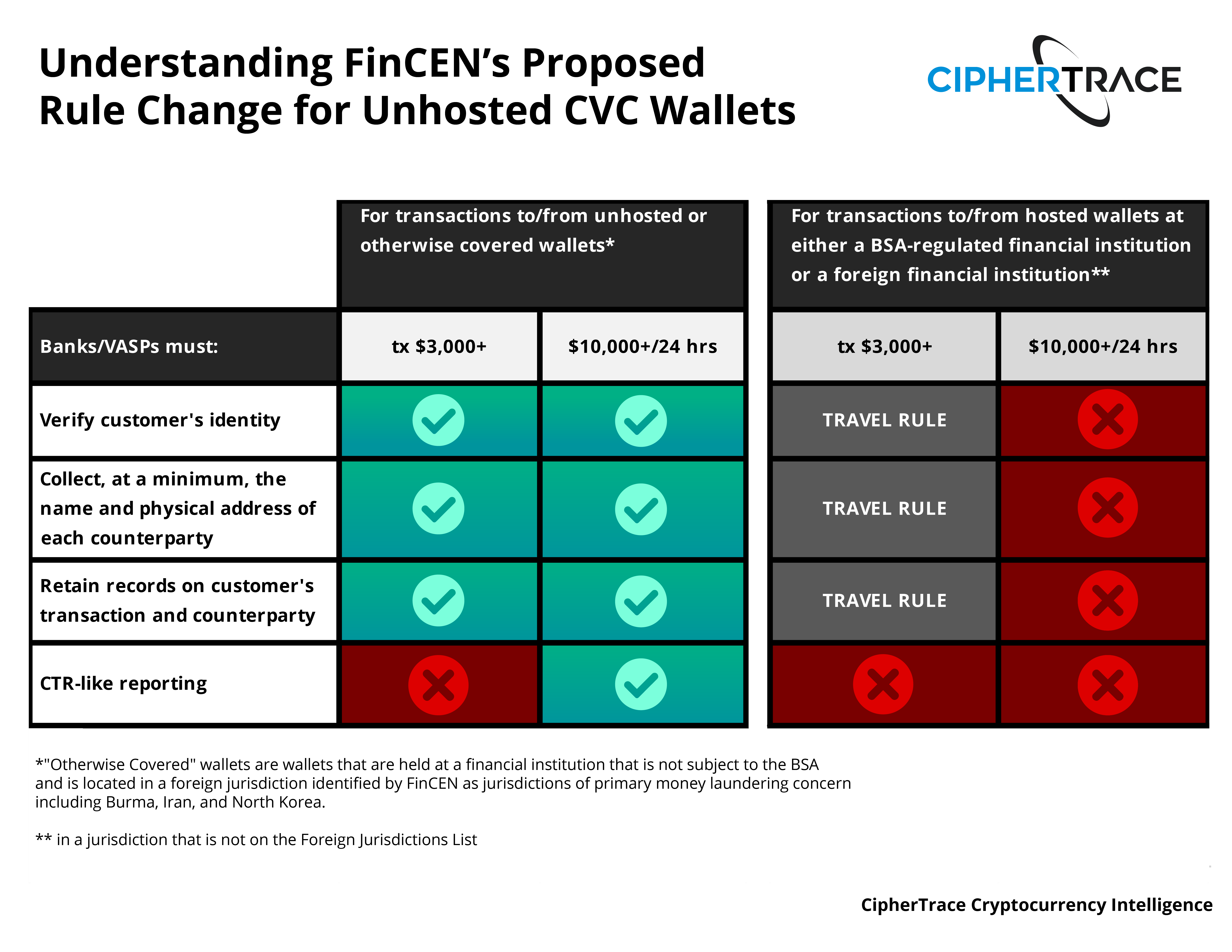

Another NPRM issued in December would require banks and VASPs to verify the identity of their customers, keep records of virtual currency transactions greater than $3,000, and submit CTR-like reports for virtual currency transactions over $10,000, if the counterparty in the transaction uses an unhosted (noncustodial) or "otherwise covered" wallet. The NPRM defines "otherwise covered" wallets as wallets held at a financial institution that is not subject to the BSA and is located in a foreign jurisdiction identified by FinCEN as being of primary money laundering concern, such as Burma, Iran, and North Korea.

Upon taking office in January 2021, the Biden administration has declared a freeze on all agency rule-making, pending a review by a department or agency head appointed or designated by the President. While the Trump administration had already extended the unhosted wallet NPRM for 15 days regarding the $10,000 threshold and 45 days regarding the remaining rules, FinCEN has since extended and consolidated both deadlines to 60 days. There has yet to be an indication that the "Travel Rule" NPRM will get a similar reopening and extension.

It is likely that these rules—or something close to them—will take effect in the first half of 2021, creating significant new crypto compliance requirements and dramatically increasing the sense of urgency felt by banks and VASPs to file crypto CTRs and SARs.

Globally, FATF released their 12-Month Review of the Revised FATF Standards on Virtual Assets and Virtual Asset Service Providers in June. In it, FATF decided not to revise previous recommendations related to virtual assets or VASPs but has documented the need for future continued direction. Reassessment of progress towards a Travel Rule solution and further guidance is slated for June 2021, at the next 12-month review.

[1] This is the average value after excluding the large PlusToken and Wotoken outliers.

Highlights

Highlights of key findings are as follows:

- As legitimate cryptocurrency use goes up, crypto crime as a percentage goes down. 2020 crypto crime was down 57% from 2019,dropping from $4.5 billion to $1.9 billion in 2020.

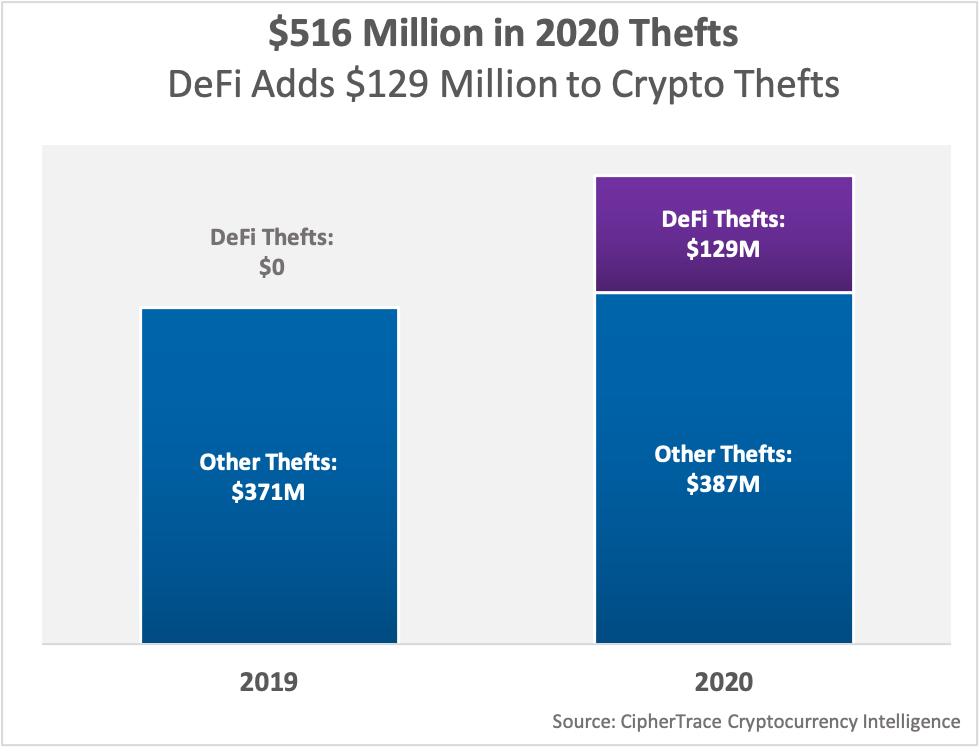

- Decentralized finance (DeFi) is the next major threat vector for fraud and money laundering: half of all thefts in 2020, totaling $129 million, were DeFi-related hacks and some centralized exchanges, such as Shapeshift, are transforming into decentralized exchanges (DEXs) to avoid KYC requirements.

- Exchange executives face arrest, extradition, and massive fines, as individuals are held personally accountable for money laundering

- Fraud is the dominant cryptocurrency crime, followed by theft and ransomware.

- US exchanges sent $41.2 million worth of BTC directly to criminals in 2020.

- 84% of the bitcoin moved in exchange-to-exchange transactions was moved cross-border.

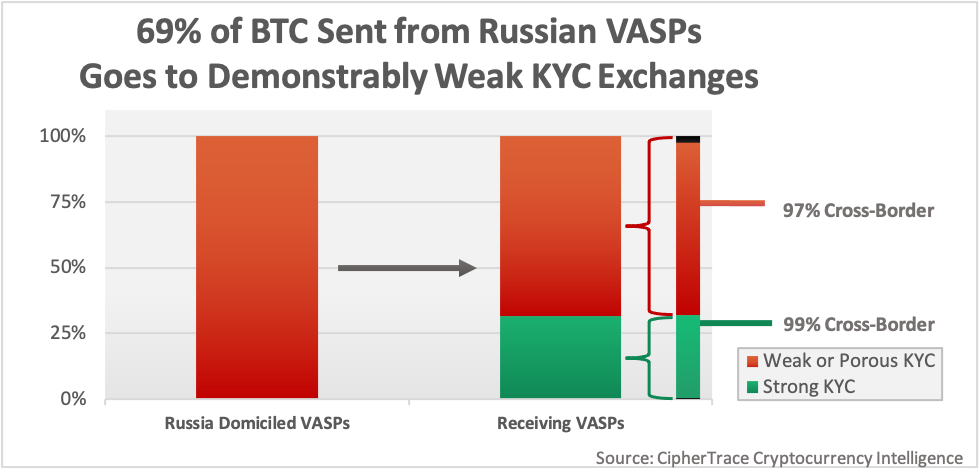

- A third of cross-border Bitcoin volume is sent to exchanges with demonstrably weak KYC.

- Forty-one percent of the total cross-border BTC volume sent from US VASPs went to VASPs with demonstrably weak KYC; 50% of cross-border volume received by US VASPs is from exchanges with demonstrably weak KYC.

- Seventy-eight percent of BTC Volume from South Korean VASPs is from exchanges with demonstrably weak KYC.

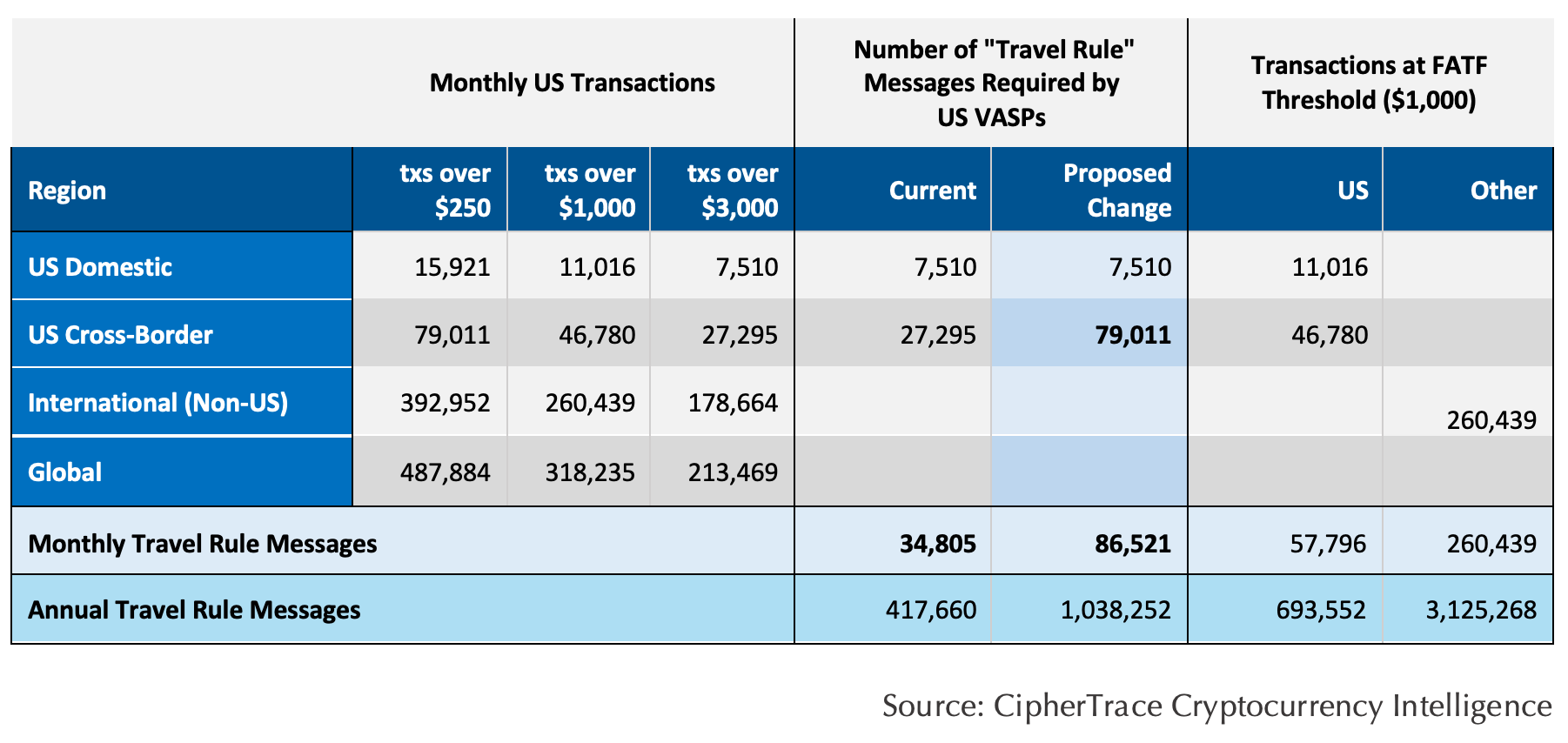

- FinCEN's proposed rule change to the "Travel Rule" threshold would more than double the number of "Travel Rule" messages needed to be sent by US VASPs.

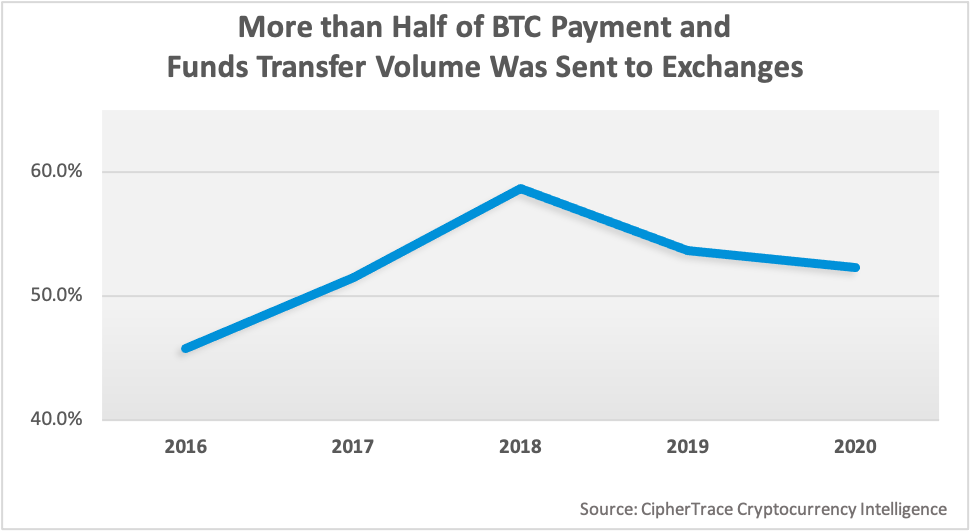

- Fifty-two percent of BTC payment volume was sent to exchanges in 2020; 40% sent to private wallets.

- The US leads the world in receiving bitcoin, with 19.3% of BTC sent to exchanges globally received by US-domiciled VASPs. Ten percent of all BTC payments were sent to US-domiciled VASPs.

- The percentage of global BTC volume sent to high-risk exchanges was at an all-time low, with a 59% drop from 2019.

Major Trends and Developments

Cash—anonymous and liquid—has long served as a tool for criminals. Cryptocurrency, with its similar characteristics, may likewise struggle to ever completely shake its bad reputation, despite illicit transactions making up less than 0.5% of Bitcoin's yearly volume in 2020. Virtual Asset Service Providers (VASPs) are the front line in preventing financial crime and identifying bad actors. However, inadequate anti-money laundering controls at a VASP can end up facilitating the flow of criminal funds around the world. As VASPs continue to mature and adopt stronger security measures, CipherTrace has found that criminals are beginning to set their sights on greener decentralized finance services over their centralized counterparts.

$3.5 Billion Sent from Criminal BTC Addresses in 2020

Criminally associated bitcoin addresses sent over $3.5 billion worth of bitcoin in 2020. This figure includes BTC addresses controlled by dark markets, ransomware actors, hackers, and fraudsters. Most of this bitcoin will ultimately need to be laundered by these criminals, meaning it will make its way to an exchange where it can be converted to fiat currency and transferred to a bank.

One US Exchange Sent More than $36.7 Million Directly to Criminals in 2020

Using cryptocurrency intelligence tools including CipherTrace Armada, analysts were able to determine that one prominent US exchange received more than $3.5 million worth of bitcoin directly from criminal sources in 2020, despite strong KYC. However, this figure is only a small amount of the criminally sourced funds that actually made it to the exchange; smart criminals will typically create distance between their illicit source of funds and their fiat off-ramp of choice. It is important to note that although the exchange received $3.5 million worth of BTC directly from criminally associated addresses, exchanges have no way of denying funds before they are received. Even if the exchange sent these funds back, the interaction will still be recorded on the blockchain.

However, this exchange also sent $36.7 million worth of bitcoin directly to criminally associated addresses. These transactions could and should have been stopped by adequate AML software. These outgoing transactions directly to criminal sources highlight the importance of accurate blockchain analytics data. Many criminals don't typically send directly to and from their criminally linked addresses when transacting with regulated exchanges, making the $36.7 million a conservative estimate of funds flowing through the exchange to the pockets of criminals. A vast majority of bad actors will move their funds at least one time. In fact, CipherTrace analysts found that a typical cryptocurrency exchange's dark market exposure will typically double at two hops out (transactions once removed from the exchange). In the case of this cryptocurrency exchange, dark market exposure more than tripled two hops out, according to CipherTrace data.

US Exchanges Sent $41.2 Million Directly to Criminals

US exchanges as a whole received $8.4 million worth of bitcoin directly from criminal addresses and sent $41.2 million worth of bitcoin directly to criminally associated addresses.

Over Half of 2020 Crypto Hacks are from DeFi Protocols

The USD value locked in DeFi has grown exponentially in 2020, thereby creating potential new money laundering risks as hacked DeFi protocols make up the majority of crypto thefts in 2020. According to CoinGecko, by the end of December 2020, DeFi had already locked 19.8 billion USD—23% of Ethereum's total market capitalization. This figure equates to more than a 1000% increase from the $1.7 billion held in DeFi at the start of 2020. This exponential boom eclipses the 70% increase from the start of 2019, when the DeFi market cap was only $1.0 billion, to the beginning of 2020. Like the altcoin boom before it, the exponential explosion of capital and lack of regulatory clarity have attracted criminal actors to DeFi, ultimately resulting in the most DeFi hacks in a year to date.

Altogether, over 50% of all 2020 thefts were DeFi hacks, equating to about $129 million—a little over 25% of the hacked volume for the year. Conversely, in 2019, the DeFi hack volume was virtually negligible. Individual DeFi thefts ranged widely, from a couple hundred thousand to tens of millions of dollars' worth of crypto tokens. CipherTrace assesses the average DeFi hack in 2020 to be worth roughly $6 million.

Even 2020's largest theft, the $281 million hack of the centralized exchange KuCoin, ultimately involved DeFi as criminals attempted to launder the stolen funds through one of the largest decentralized exchanges in the world—Uniswap. It's clear that DeFi has become one of the fastest growing trends in the crypto industry. As such, it is important to be vigilant to its money laundering risks. Decentralized exchanges often don't collect KYC information on their users and have no way of freezing funds like a centralized exchange; sometimes, this power lies with the individual DeFi projects themselves.

Notable DeFi hacks in 2020 included:

- bZx

- Akropolis

- Axion Network

- Balancer

- Bancor DEX

- Bisq

- Cheese Bank

- COVER

- Finance

- Harvest Finance

- Lendf.Me

- Opyn

- OUSD

- Pickle Finance

- Uniswap

- Value DeFi

- WarpFinance

- wLEO

DeFi Rug Pulls Emerge as Top Exit Scam

While DeFi hacks had been on the rise since as early as Q1 2020, the end of the year brought new challenges to DeFi as rug pulls and exit scams began to proliferate, reminding many crypto veterans of the "pump and dump" schemes popular at the height of the ICO boom. In the second half of 2020, nearly 99% of major fraud and misappropriations volume stemmed from DeFi protocols performing rug pulls and exit scams.

Rug pulls are similar to exit scams; both involve insiders taking off with a majority, if not all, of users' funds. While often used interchangeably, exit scams are more often linked to established entities or projects unexpectedly closing down ("exiting"), taking user funds with them. For example, in November 2020, the DeFi project SharkTron appeared to have conducted an exit scam with $10 million in user funds, closing its website and leaving users in the dark.

A rug-pull, on the other hand, is a specific type of exit scam that involves "pulling the rug" out from under investors (users) by selling the majority of the DeFi pool, thereby draining liquidity from a specific token. Rug pulls are often accomplished through intentional back doors written into smart contracts. In the case of DeFi project Compounder.Finance, a hidden backdoor written into the smart contract allowed developers to pull $10.8 million from the project's liquidity pools in November 2020. DeFi project Unicats performed a similar rug pull in October, draining the entirety of its users' funds.

In our research, CipherTrace found several incidents of DeFi rugpulls and exit scams in 2020. Unfortunately, due to a lack of definitive data, we were not able to verify each incident. Unverified incidents are not included in our overall data pool for analysis.

Notable examples of DeFi rug pulls and exit scams in 2020 included:

- Lv.Finance

- Emerald Mine

- Yfdexf.Finance

- SharkTron

- Unicats

- Compounder.Finance

- Amplifi.money (unverified)

- Burn Vault Finance (unverified)

- Minions Farm (unverified)

- Unirocket (unverified)

This trend is likely to continue into 2021 without proper audits of smart contracts, continued education of investors, and relevant regulations on these new risk vectors.

Future of DeFi Hacks, Scams, and Regulation

DeFi protocols are permissionless by design, meaning they often lack regulatory oversight , and anyone in any country can access them with little or no KYC required. As a result, we have seen DeFi become a haven for money launderers in the last months of 2020.

"[DeFi Projects] are likely subject to various laws already, including securities law, potentially banking and lending laws—definitely AML/CTF laws."

-Valerie Szczepanik, SEC

It appears regulators are beginning to pay closer attention to DeFi and associated compliance requirements. The unaudited smart contracts on which many DeFi projects rely often have vulnerabilities that bad actors can exploit. As Olaf Carlson-Wee, the founder and CEO of Polychain Capital, said on a September 8 episode of Unchained, "I do think it scares me a little bit how much capital is being dumped into contracts that are unaudited. I think that getting security audits is, overall, an important part of maturing any one of these systems." As DeFi continues to grow, it's plausible to expect that DeFi projects could fall under the scope of global regulators. FATF already considers decentralized exchanges to be VASPs, and FinCEN applies the same regulatory consideration to DEXs that it does to bitcoin ATMs, regardless of whether they operate for profit.

The US Securities and Exchange Commission staff has noticed DeFi projects that have been subject to vulnerabilities, hacks, attacks, fraud, and manipulation. At the September 18 Parallel Summit, the SEC's Crypto Czar Valerie Szczepanik said, "When you are running [Defi] things on code and you are putting it out in the wild, you are missing a step there where you may want to test the code, you may want to audit the code, you may want to have some peer review of the code. To send it out live right away without those protections is risky."

"Don't feed into the hype that surrounded the ICO market," warned Val. "Hype leads to fraud; it can lead to bad implementations of code and insufficient testing. If the industry takes the time to get it right and engages with regulators to help them do so, then all the good stuff will percolate to the top and you will have the benefits that come with the promise of distributed ledger technology."

Val said "we've seen structures that purport to enable users to lend money, earn interest, borrow money, exchange, take positions; these are all financial activities, and they are likely subject to various laws already, including securities law, potentially banking and lending laws—definitely AML/CTF laws."

The EU, meanwhile, has introduced Markets in Crypto-Assets (MiCA), a proposed regulation which, if passed, will ban decentralized exchanges from trading with any European Union citizens if they are not incorporated as a legal entity and have their registered office in a Member State.

FinCEN's Proposed Rulemaking Creates New Reporting and Record-Keeping Requirements for Transactions to Unhosted Wallets

On December 18, 2020, the US Department of Treasury issued a notice of proposed rulemaking (NPRM) that will require financial institutions subject to the BSA to verify the identity of their customer, keep records of convertible virtual currency (CVC) transactions greater than $3,000, and submit CTR-like reports for CVC transactions over $10,000, if the counterparty in the transaction uses an unhosted (noncustodial) or "otherwise covered" wallet. The NPRM defines "otherwise covered" wallets as those wallets that are held at a financial institution that is not subject to the BSA and is located in a foreign jurisdiction identified by FinCEN as being of primary money laundering concern, a list that includes Burma, Iran, and North Korea.

These rules were proposed under the Trump administration. In January 2021, the incoming Biden administration declared a freeze on agency rulemaking, which includes these proposed changes. However, the freeze is only temporary, pending review by a department or agency head appointed or designated by President Biden. While the Trump administration had already extended the unhosted wallet NPRM for 15 days regarding the $10,000 threshold and 45 days regarding the remaining rules, FinCEN has since extended and consolidated both deadlines to 60 days. There has yet to be an indication that the "Travel Rule" NPRM will get a similar reopening and extension.

Many BSA officers felt that the regulation of unhosted wallets was inevitable, and that the proposed rules are a reasonable response to the current and future money laundering risk posed by the potentially large unmonitored flow of funds to and from unhosted wallets. The proposed rule will be expensive to implement and it is anticipated that these costs will be passed on to users.

If adopted, the new rule will further enforce the requirement for VASPs, as well as banks engaged in crypto transactions, to be able to identify whether a counterparty is another VASP or not, and if so, where that VASP is domiciled. Current regulations already impose this burden on VASPs under the Travel Rule, with additional rules now set for certain transactions to unhosted wallets and otherwise covered jurisdictions, closing AML gaps not covered by Travel Rule regulations. CipherTrace blockchain analytics tools can help your institution determine if a counterparty address belongs to a hosted, unhosted, or "otherwise covered" wallet, which is the crux of the new proposed rule.

The new rule also requires that VASPs aggregate cryptocurrency transactions over a 24-hour period to report transactions over $10k and identify any signs of structuring. Crypto and cash transactions do not need to be combined when aggregating. CipherTrace is uniquely capable to help VASPs and banks aggregate multi-chain aggregation payments and leverage predictive analytics to identify structuring.

Unhosted Wallets Dominate BTC Volume Going to and from US Exchanges

In 2020, 70% of US Exchanges' outgoing bitcoin volume was sent to unhosted wallets; 52.1% of incoming BTC volume came from unhosted wallets.

By comparison, only about 26.5% of the outgoing BTC volume sent by US exchanges went to other exchanges, and about 42.6% of incoming BTC volume came from other exchanges.

Potential Implications of the Proposed Rule

Blockchain analytics solutions enable crypto exchanges to identify risky transactions involving unhosted wallets. VASPs can follow the funds trail through unhosted wallet addresses, obtaining insights about exposure to high-risk addresses and counterparties. This transparency enables insights about risks associated with unhosted cryptoasset wallets that is impossible to obtain when dealing in fiat currencies or cash.

These proposed requirements are essentially just the application of cash rules (cash and electronic funds transfers) financial institutions have long complied with, now applied to certain virtual asset transactions. However, from an investigatory standpoint, the proposed rule will likely run criminal activity to more hidden corners of the blockchain, which will severely hamper the success of investigations. Instead of using exchanges, criminals will likely move towards unregistered P2P exchanges to keep off the radar. Most investigations are successful when cryptocurrency hits a regulated exchange; by forcing criminal activity out of the exchanges, investigators will lose one of their most powerful tools for tracking, tracing and identifying criminals and their activity.

US "Travel Rule" Rule Making's Lower Threshold Could Double the Compliance Triggers for VASPs

On October 23, the Financial Crimes Enforcement Network (FinCEN) and the Federal Reserve Board proposed a rule change that would require financial institutions, including banks and cryptocurrency exchanges, to collect, store, and transfer information on international payments at a much lower threshold.

Currently, financial intuitions must store and forward records for transfers of funds abroad in excess of $3000. The new rule would see much smaller transfers—anything over $250—come under the same requirements. Notably, the rule specifically includes cryptocurrency transfers as a class of transactions to which the proposal would apply.

Decreasing the threshold to collect, retain, and transmit information on the transmittals of funds that "begin or end outside the United States" would increase the number of transactions that trigger Travel Rule thresholds every year by a factor of at least 2.5, according to CipherTrace analysis.

According to CipherTrace data, US VASPs would have had to have sent over 34,000 messages during the month of October 2020 in order to comply with the current US Travel Rule threshold of $3,000. Over 27,000 of these messages—around 78%—would have been cross-border in nature, meaning the sending or receiving VASP was domiciled outside of the United States. Thistranslates to over 417,000 messages a year at the current threshold.

Lowering the threshold to $250 would push the number of required travel rule messages to be shared and stored per year to over one million. At this lower threshold, cross-border transactions make up 83% of all travel rule triggers for US VASPs.

If the US were only to lower its threshold to FATF's de minimis standard of $1,000, then the number of transactions that would trigger compliance would increase by a factor of 1.7 every year.

Intermediary banks or financial institutions are also required to transmit this information to other banks or nonbank financial institutions in the payment chain. The proposed rule change acknowledges that cryptocurrency can be transferred without third-party bank involvement but states that, in reality, many users rely on hosted wallets and exchanges to transact.

Difficulty in determining "cross-border payments" in the virtual asset world

FinCEN's proposed rule change is based on transactions that "begin or end outside the United States." These transactions are defined by whether a financial institution "knows or has reason to know that the transmittor, transmittor's financial institution, recipient, or recipient's financial institution is located in, is ordinarily resident in, or is organized under the laws of a jurisdiction other than the United States or a jurisdiction within the United States."

Due to the cross-border nature and global reach of virtual assets and VASPs, compliance with this definition would be difficult to enforce, especially given many VASPs are registered in multiple jurisdictions around the world. A financial institution would only have "reason to know" that a transaction begins or ends outside the United States to the extent that such information was shared when receiving the transmittal order or collected from the transmittor—assuming he or she even knows the true extent of the cross-border nature of their transaction.

"Countries should treat all VA transfers as cross-border wire transfers, in accordance with the Interpretative Note to Recommendation 16 (INR. 16), rather than domestic wire transfers, based on the cross-border nature of VA activities and VASP operations."

-Financial Action Task Force

It is for this reason that the FATF decided in its June 2019 virtual asset guidance that "countries should treat all VA transfers as cross-border wire transfers, in accordance with the Interpretative Note to Recommendation 16 (INR. 16), rather than domestic wire transfers, based on the cross-border nature of VA activities and VASP operations."

Over One Third of Cross-Border Bitcoin Volume is Sent to Exchanges with Demonstrably Weak KYC

In 2020, cross-border bitcoin transactions constituted 84% of all VASP outflow volume globally. Over one-third—36%—of this cross-border BTC volume went to VASPs with weak or porous KYC procedures.

US Spotlight

A deeper look into the inflows and outflows of VASPs by jurisdiction revealed that 98% of the outgoing BTC volume from US VASPs is from exchanges with strong KYC procedures. When analyzing US VASPs outbound transaction volume for 2020, CipherTrace researchers found that 24% of the BTC volume sent to Virtual Asset Service Providers went to VASPs with weak or porous KYC. Of the 24% of outgoing exchange-to-exchange volume, 98% was cross-border. Comparatively, only 44% of the outgoing exchange-to-exchange volume to exchanges with strong KYC was cross-border.

"… CipherTrace found that 58% of the exchange-to-exchange BTC volume was cross-border, with 41% of the total cross-border volume being sent to VASPs with weak or porous KYC."

In total, when looking at the outflows of US VASPS, CipherTrace found that 58% of the exchange-to-exchange BTC volume was cross-border, with 41% of the total cross-border volume being sent to VASPs with weak or porous KYC.

Inversely, when looking at the inflows of US VASPs, 74% of their inbound exchange-to-exchange BTC volume was cross-border. Of this cross-border volume, 50% originated from crypto exchanges with weak or porous KYC practices.

The high percentage of cross-border volume going to and coming from weak or porous VASPs severely complicates the purpose of "Travel Rule" regulations. These KYC-deficient VASPs likely won't collect or retain the information law enforcement needs to move on any actionable intelligence.

Cross Border BTC Volume Around the Globe

When looking at the outflows of South Korean-domiciled VASPS, CipherTrace found that 63% of the exchange-to-exchange BTC volume was cross-border, with 53% of the total cross-border volume being sent to VASPs with demonstrably weak KYC.

When looking at the outflows of Seychelles-domiciled VASPS, CipherTrace found that 96% of the exchange-to-exchange BTC volume was cross-border, with 51% of the total cross-border volume being sent to VASPs with demonstrably weak KYC.

When looking at the outflows of Singapore-domiciled VASPS, CipherTrace found that 98% of the exchange-to-exchange BTC volume was cross-border, with 49% of the total cross-border volume being sent to VASPs with demonstrably weak KYC.

When looking at the outflows of Russian VASPS, CipherTrace found that 98% of the exchange-to-exchange BTC volume was cross-border, with 49% of the total cross-border volume being sent to VASPs with demonstrably weak KYC.

Effective KYC protocols are a vital part of any AML program. Understanding KYC processes of counterparty institutions can help financial institutions better understand and manage your risks and prevent money laundering. However, it's one thing to have strong KYC guidelines on paper and another to implement them. By analyzing and probing the KYC processes of more than 800 VASPs in 80+ countries, CipherTrace was able to geographically locate where weak and porous KYC could be exploited by money launderers, criminals, and extremists. To learn more about average KYC scores by region, check out our 2020 Geographic Risk Report: VASP KYC by Jurisdiction here: https://ciphertrace.com/2020-geo-risk-report-on-vasp-kyc/

Exchanges Receive Over Half of BTC Payments in 2020

Over half—52.3%—of BTC payment and transfer transaction volume was sent to exchanges in 2020; 40% of payment volume was sent to private wallets.

For this analysis, CipherTrace has identified payment and funds transfers by filtering out blockchain data within the same entity (for example, any transactions from Binance to Binance). This filtering eliminates a large chunk of blockchain data that represents internal transactions within virtual asset entities that skew the overall picture of where crypto funds move. By removing this data, analysts can get a better idea of payment flows on the blockchain, rather than analyzing the entire, unfiltered pool of blockchain data.

Likewise, CipherTrace has also filtered out criminals sending funds back to themselves (e.g. peel-chains) and private wallet-to-private wallet transactions as these, too, can artificially inflate the data. In private wallet-to-private wallet transactions, it is impossible to know when individuals are moving funds to different accounts under their control, or engaging in P2P trading.

However, while the overall global percentage of BTC volume received by exchanges appears to be dropping, the actual amount of BTC sent to exchanges has increased between 2019 and 2020 by more than 6.3 million BTC, worth roughly $150 billion. Together, these trends likely mean that, while exchanges continue to grow in popularity, BTC is beginning to see more widespread use outside of exchanges.

While over half of BTC payments volume went to exchanges in 2020, a majority of that volume was from exchanges in five countries: the US, the Cayman Islands, South Korea, Japan, and the Seychelles. US-based exchanges received the most, at 10% of all BTC volume globally—or 19% of all BTC volume received by exchanges.

Percentage BTC Volume Sent to High-Risk Exchanges Reaches All-Time Low

2020 saw a 59% drop in the percentage of global BTC volume received by high-risk exchanges. There are several factors that determine when an entity is categorized as a "high-risk exchange." These factors include, but are not limited to, the following:

- they are known bad actors,

- they intentionally try to circumvent AML and KYC measures,

- and/or they are known to regularly fail to cooperate with law enforcement and regulators.

High-risk exchanges are known for being avenues of money laundering.

While criminals continue to use high-risk exchanges as fiat off-ramps, CipherTrace investigators continue to see more centralized, mainstream exchanges on the receiving end of criminal funds—albeit often after attempts to obfuscate and distance the funds from their criminal sources through the use of peel chains, mixers, or other obfuscation techniques.

Terrorist Use of Cryptocurrency in 2020

Terrorist organizations and their supporters and sympathizers are continuously looking for new ways to raise and transfer funds without detection or tracking by law enforcement. An asset like cryptocurrency, which allows for the instant, pseudonymized transmission of value around the world with no due diligence or recordkeeping, was bound to catch their eye. Fortunately, the use of blockchain analytics coupled with diligent investigations by law enforcement have resulted in major foiling of terrorist financing networks in 2020.

DOJ Seizures of Cryptocurrency Donations Puts a $2 Million Hole in Terrorist Finances

On August 13, the U.S. Department of Justice announced the seizure of $2 million in cryptocurrency from prominent terrorist groups, including al-Qaeda, ISIS, and Hamas. The funds came from cryptocurrency donations the groups solicited online via social media and their own websites.

"It should not surprise anyone that our enemies use modern technology, social media platforms and cryptocurrency to facilitate their evil and violent agendas…"

– Attorney General William Barr

Terrorist groups like these use cryptocurrency to buy weapons, train operatives, and cover international transportation costs. "It should not surprise anyone that our enemies use modern technology, social media platforms and cryptocurrency to facilitate their evil and violent agendas," said then-Attorney General William Barr.

Authorities conducted their investigation in concert with covert operators. In addition to donations, terrorists garnered funds through fake charity fronts and scams involving the sale of protective supplies related to the coronavirus pandemic, according to IRS's Don Fort.

Highlighted in the DOJ report was Hamas's use of bitcoin donations via a Telegram channel run by its military wing, known as the Qassam Brigades. CipherTrace had previously reported on this exact scheme in our Q3 2019 report. While it appears the operation brought in only the rough equivalent of $5000 to the terrorist organization, it is important to remember that the cost of carrying out a terrorist attack can be very low.

Jason Blazakis, former director of the Finance and Designations Office at the US Department of State's Bureau of Counterterrorism, and current director of the Center on Terrorism, Extremism, and Counterterrorism, explained, "[T]errorists don't have to raise a lot of crypto or cash to maintain sanctuary for sleeper cells or, worse yet, the ammunition, guns, and bombs that can maim innocent civilians. While a thousand dollars may not seem like a lot of money, in the hands of the wrong person, it can do all of the above and much more."

French Police Arrest Twenty-Nine in Cryptocurrency Terrorism Financing Scheme

On September 30, 2020, law enforcement arrested 29 French operatives linked to a terrorism financing operation which used cryptocurrency "coupons" in an attempt to obfuscate the source and flow of funds. The French operatives are believed to be affiliated with the Hayat Tahrir Al-Sham organization, an Al-Qaeda affiliate.

The French operatives purchased "hundreds of thousands of euros" worth of cryptocurrency "coupons" from licensed tobacco outlets in France and sent the credentials on the coupons to jihadists in Syria, where the Bitcoin could be redeemed online. France's financial intelligence unit, Tracfin, was able to detect the financial flows from France to Syria after constant surveillance of the group led authorities to several dozen people living in France that "had visited repeatedly, over the past few months, tobacco shops throughout the country to anonymously purchase coupons worth between €10 and €150 [that] were then credited to accounts opened from abroad by jihadists," according to the national anti-terrorism prosecutor's office.

Major 2020 Enforcement Actions

2020 was the year of widespread crypto adoption and price gains, making crypto fraudsters and those in regulatory noncompliance the prime target for enforcement actions. VASPs must adhere to local laws when doing business with their citizens. Aside from deep fines, personal liability and potential jail time loom for those who willfully disregard anti-money laundering laws in many jurisdictions.

BitMEX Executives Charged with Illegal Operations and Anti-Money Laundering Violations

On October 1, the US Department of Justice (DoJ) announced the indictment of four BitMEX executives, charging the group with violating the Bank Secrecy Act (BSA), and conspiring to violate the BSA by "willfully failing to establish, implement, and maintain an adequate anti-money laundering ("AML") program." On the same day, the Commodity Futures Trading Commission (CFTC) filed a civil enforcement action charging five entities and three individuals that own and operate the BitMEX trading platform, including BitMEX CEO Arthur Hayes.

These charges include operating an unregistered trading platform and violating multiple CFTC regulations such as failing to implement AML procedures while generating $1B USD in transaction fees. The defendants each face up to 10 years in jail and the CFTC's injunction may top $1.3B USD, making it one of the most expensive AML penalty ever paid by a financial institution.

BitMEX had been under investigation by the CFTC since early 2019 for allowing Americans to trade on their exchange. While the platform claimed to have improved their Customer Identification Program to effectively exclude US persons, the CFTC complaint alleged otherwise. According to the complaint, BitMEX is a maze of corporate entities all owned and controlled by the same people, doing business as the same name. These businesses include: HDR Global Trading Limited, 100x Holdings, ABS Global Trading, Shine Effort, and HDR Services.

According to the CFTC, HDR Global Trading Limited operated the BitMEX trading platform. Despite being incorporated in the Seychelles, "HDR does not have, and never has had, any operations or employees in the Seychelles." Despite being domiciled in the Seychelles, Hayes held his ownership interest in BitMEX entities through a Delaware limited liability company that maintains bank accounts at financial institutions in the US. Despite serving at least 85,000 US customers and managing a large portion of its trading infrastructure from within the US—with half the its employees working from San Francisco or New York offices—BitMEX never registered with the CFTC.

AML Deficiencies and Failure to Report Suspicious Activity

The complaint also claimed that BitMEX not only failed to comply with record keeping obligations, but the company was actively deleted critical customer identification information. In certain cases, these records were deleted "explicitly because a user was found to be located in the US or another restricted jurisdiction." The DOJ complaint adds that from BitMEX's launch in late 2014 to at least in or about September 2020, the exchange did not file any SARs, failing to report suspected illegal activity on the platform.

Addressing the DOJ indictment, Acting Manhattan US Attorney Audrey Strauss said, "With the opportunities and advantages of operating a financial institution in the United States comes the obligation for those businesses to do their part to help in driving out crime and corruption. As alleged, these defendants flouted that obligation and undertook to operate a purportedly 'off-shore' crypto exchange while willfully failing to implement and maintain even basic anti-money laundering policies. In so doing, they allegedly allowed BitMEX to operate as a platform in the shadows of the financial markets. Today's indictment is another push by this Office and our partners at the FBI to bring platforms for money laundering into the light."

BitMEX responded to the charges on their website, stating "We strongly disagree with the U.S. government's heavy-handed decision to bring these charges, and intend to defend the allegations vigorously. From our early days as a start-up, we have always sought to comply with applicable U.S. laws, as those laws were understood at the time and based on available guidance."

Steps to Improve AML Compliance

In an effort to improve compliance, BitMEX has already taken steps to increase their AML procedures. Since the indictment, BitMEX has hired Malcolm Wright, an associate fellow of the Centre for Financial Crime and Security Studies at the UK's Royal United Services Institute, as the company's Chief Compliance Officer. Wright will monitor the exchange's global compliance activities, and directly report to Vivien Khoo, acting interim CEO and COO of BitMEX. It is still unclear as to whether BitMEX had a CCO before Wright.

Upon reevaluating BitMEX's KYC, CipherTrace has found that the exchange has already improved its practices, moving the exchange from a "porous" (yellow) score since the release of our Geographic Risk Report earlier this month, to a "strong" (green) KYC score. This further corroborates BitMEX's position on strengthening their compliance procedures, proving the effort to hire a new CCO isn't in jest.

Ripple, Execs Face SEC Lawsuit

The US Securities and Exchange Commission filed a lawsuit on December 22 against Ripple, Ripple CEO Brad Garlinghouse, and Chris Larsen, a co-founder of the company, alleging that the firm's sale of XRP constituted an offering of unregistered securities.

Ripple responded to the lawsuit in a Wells Submission— a document where the person or business facing an enforcement actions has the opportunity to present facts and legal arguments to convince the SEC that no action should be brought. In their Wells Submission, Ripple claims that "by alleging that Ripple's distributions of XRP are investment contracts while maintaining that bitcoin and ether are not securities, the Commission is picking virtual currency winners and losers, destroying U.S.-based, consumer-friendly innovation in the process." However, bitcoin and ether's decentralized nature have saved them from SEC enforcement. XRP, on the other hand, is much more centralized.

Many exchanges have suspended or delisted XRP pending the results of the SEC lawsuit. This list includes: Binance.US, Coinbase, eToro, and Bittrex. Some investment firms with XRP positions, such as Greyscale and Bitwise Asset Management, have also liquidated their holdings.

Speaking on an episode of the Pomp Podcast a month prior to the SEC's decision, Garlinghouse stated he believes that his company would still thrive under a "hypothetical scenario" where XRP is declared a security. Garlinghouse later adds that "more than 90% of RippleNet customers are out of the United States." However, the lawsuit and subsequent delistings have caused the price of XRP to plummet while most coins remain bullish, affected countless XRP retail holders with no connection to Ripple or the United States.

A virtual pretrial is set for February 22, 2021.

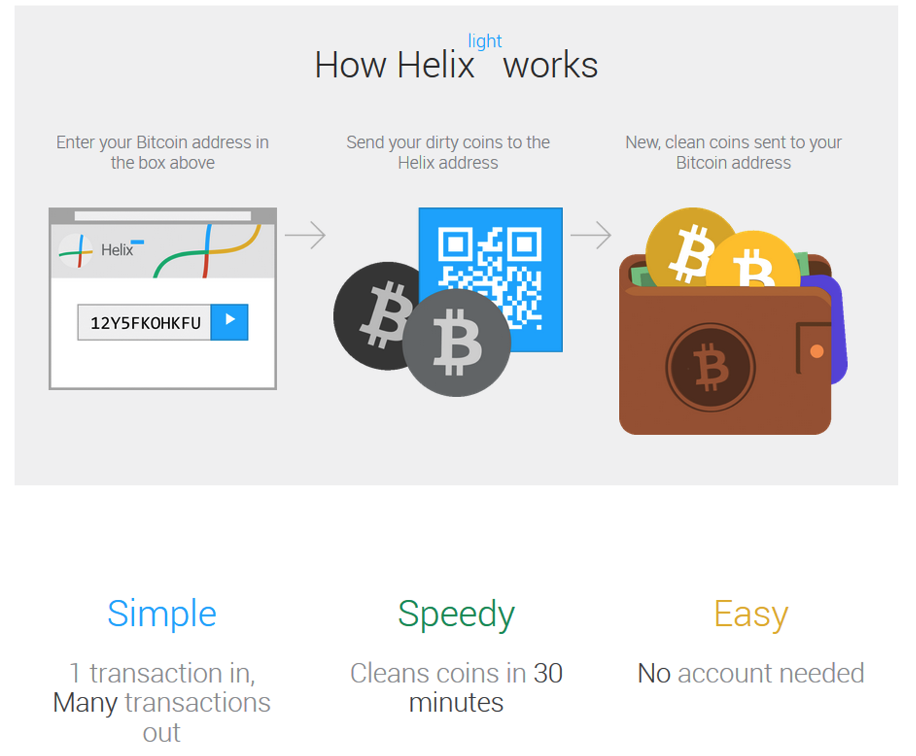

FinCEN Fines Operator of Helix Mixer $60M for Bitcoin Laundering Scheme Linked to Notorious Dark Markets

In one of the most significant takedowns of a cryptocurrency-anonymizing service, Federal law enforcement authorities arrested Larry Dean Harmon of Akron, Ohio, in February for money laundering. Harmon's Helix "tumbling" operation moved approximately $300 million in bitcoin. The Department of Justice alleged that Helix had partnered with now-defunct underground marketplace AlphaBay, which was known for drug dealing and other illegal activities until it was shut down in 2017 by law enforcement.

According to the indictment, Helix made it possible for customers to send bitcoin in a manner that was designed to conceal the transaction and the owner of the bitcoin. Think of a tumbler or "mixer" as being analogous to blender into which you put various types of fruit to make a smoothie. Once the blades spin it is virtually impossible to distinguish the banana from the strawberry. Likewise, once the anonymizing service mixes clean crypto with cryptocurrency that was stolen or used for criminal activities such as selling drugs, it becomes very difficult to trace the bad funds back to the source. "The brazenness with which Helix operated should be the most appalling aspect of this operation to everyday citizens," said Don Fort, chief of the IRS Criminal Investigation division. "There are bad actors and then there are criminals who facilitate hundreds of other crimes. The sole purpose of Harmon's operation was to conceal criminal transactions from law enforcement.

Eight months later, on October 19, FinCEN announced a $60 million civil money penalty against Harmon, for violations of the Bank Secrecy Act (BSA) and its implementing regulations. By accepting and transmitting bitcoin through a variety of means, Harmon operated as an exchanger of convertible virtual currencies. FinCEN found that Harmon willfully violated the BSA's registration, program, and reporting requirements by failing to register as a MSB, failing to implement and maintain an effective anti-money laundering program, and failing to report suspicious activities.

BitGo Enters Into $98,830 Settlement with US Treasury Over Multiple Crypto Sanctions Violations

According to a December 30 Enforcement Release by the US Treasury's Office of Foreign Asset Controls, institutional crypto custodian service and wallet operator BitGo failed to prevent persons apparently located in sanctioned jurisdictions from opening accounts and sending digital currencies via its platform.

The release notes that there were 183 apparent violations, adding up to over $9,000, in transactions sent to the Crimea region of Ukraine, Cuba, Iran, Sudan, and Syria. Treasury claims BitGo had reason to know that these users were located in sanctioned jurisdictions based on IP data collected when users log in to the platform, but that BitGo lacked any controls to block users in sanctioned jurisdictions from accessing its services.

Although the statutory maximum civil monetary penalty applicable in these matters is $53,051,675, OFAC determined that the Apparent Violations constituted a "non-egregious case" and the two parties came to a settlement of $93,830. The fact that BitGo is a small company, cooperated with OFAC's investigation into the violations, and invested in significant remedial measures in response to the violation were mitigating factors that contributed to the lower settlement amount.

OFAC emphasized in the enforcement action that sanctions compliance obligations apply to all US persons, including those involved in providing digital currency services. This action came two months after OFAC had issued an advisory warning of potential sanctions violations for allowing customers to pay ransomware.

FBI and German Police Charge Operators of movie2k.to and Seize $30 Million in Crypto

As a result of a joint investigation between the FBI and German authorities, over 25 million euros' worth of cryptocurrency—$29.6 million worth of Bitcoin (BTC) and Bitcoin Cash (BCH)—was seized from those implicated in the illegal movie streaming site movie2k.to on August 6.

According to the German newspaper Der Spiegel, movie2k.to was one of the largest platforms for the sharing of pirated movies. The site was officially shut down in spring 2013 due to copyright infringement concerns; prior to the shutdown, the site's operators were allegedly able to distribute 880,000 pirated copies of films. One of movie2k.to's operators, who worked as the site's programmer, has been in police custody since November 2019. The programmer has now comprehensively confessed to the charges and is reportedly assisting authorities in their continuing investigations into the second main operator, who remains on the run.

US Attorney's Office Charges Man with Operating Unlicensed ATM Network

The US Attorney's office released a statement detailing the guilty plea of a Yorba Linda man, Kais Mohammad, for his involvement in Herocoin—an illegal cryptocurrency business that exchanged up to $25 million through in-person transactions and a network of Bitcoin ATM kiosks.

According to his plea agreement, Mohammad offered in-person bitcoin-for-cash exchange services, in amounts up to $25,000. In a typical arrangement, Mohammad generally did not ask about the source of clients' funds and, on many occasions, he knew the funds had originated from criminal activity.

Mohammad also owned a network of Bitcoin ATM-type kiosks located in a network of malls, gas stations, and convenience stores across the greater LA area. These kiosks allowed customers to buy bitcoin with cash, or to sell bitcoin in exchange for cash.

According to his plea agreement, Mohammad knowingly decided not to register Herocoin with the US Treasury Department's Financial Crimes Enforcement Network (FinCEN). He also reportedly refused to develop an effective anti-money laundering program and failed to file currency transaction reports for suspicious exchanges.

While bitcoin ATMs have been known to service criminals and scammers in the past, the global regulatory landscape is tightening for crypto ATM operators. New legislation has been created in countries around the world specifically to regulate businesses that swap crypto for cash, requiring them to obtain KYC information on all transactions over a certain threshold. This KYC information gathering and record keeping is also a critical step in complying with Travel Rule regulations that crypto ATM operators must abide by. These regulations are critical for governments to prosecute and stop those using bitcoin to launder illegal funds.

Fifteen Plead Guilty After Implication in International Crypto-Crime Ring

On June 16th, Vlad-Călin Nistor—the owner of crypto exchange CoinFlux—and 14 of his associates entered guilty pleas for their involvement in an international cryptocurrency scam. According to the U.S. Department of Justice, this crime ring was responsible for fraudulent online auctions used to launder money through Nistor's cryptocurrency exchange, where they would exchange cryptocurrency for fiat and then deposit the funds into bank accounts under the names of CoinFlux employees and family members.

Regarding the investigation, Assistant Attorney General Brian Benczkowski of the Justice Department's Criminal Division commented, "Today's modern cybercriminals rely on increasingly sophisticated techniques to defraud victims, often masquerading as legitimate businesses." He continued, "These guilty pleas demonstrate that the United States will hold accountable foreign and domestic criminal enterprises and their enablers, including crooked bitcoin exchanges that swindle the American public."

The real danger, though, may come from other nation-state actors who seek to replicate this behavior by using cryptocurrency exchanges to cover their tracks. Attorney General Benczkowski highlighted this danger in his press release, stating that, "this time [a cryptocurrency exchange] was being used by criminal fraudsters, but there are definitely parallels in what we've already seen from nation-state actors."

This case demonstrates how cryptocurrency exchanges can be abused to launder funds, highlighting the importance of Travel Rule regulations. Exchanges with poor KYC or in regions with weak AML controls make trusting and sharing this evidence even harder.

DOJ Charges Founder of "AML Bitcoin" with Money Laundering

On June 22, the US Department of Justice charged the CEO of NAC Foundation and founder of AML Bitcoin, Marcus Andrade, with wire fraud and money laundering. The SEC announced parallel criminal actions against Andrade for conducting a fraudulent, unregistered offering of AML Bitcoin and defrauding investors.

The SEC alleged NAC Foundation raised nearly $5.6 million from more than 2,400 investors by selling tokens that could later be converted to AML Bitcoin. The AML Bitcoin Whitepaper portrayed the token as superior to the original bitcoin because it allegedly had anti-money laundering, anti-terrorism, and theft-resistant technology built into the coin, which would reside on NAC's own "privately regulated public blockchain." However, the SEC's complaints allege that none of these capabilities actually existed.

Kristina Littman, Chief of the SEC Enforcement Division's Cyber Unit, stated Andrade "repeatedly misled investors into funding non-existent technology, falsely claiming that the technology would make digital asset transactions more secure," adding, "Investors are entitled to truthful information so they can make fully informed investment decisions."

SEC Orders Telegram to Return $1.2 Billion to Investors, Pay $18.5 Million Penalty to Settle Charges

On June 26, the SEC obtained court approval of settlements with Telegram to resolve charges that its unregistered ICO of "Grams" violated federal securities laws. According to the settlement, without admitting or denying the allegations, the defendants agreed to return more than $1.2 billion to investors and to pay an $18.5 million civil penalty.

Kristina Littman, Chief of the SEC Enforcement Division's Cyber Unit, noted that "new and innovative businesses are welcome to participate in our capital markets but they cannot do so in violation of the registration requirements of the federal securities laws." She added, "This settlement requires Telegram to return funds to investors, imposes a significant penalty, and requires Telegram to give notice of future digital offerings."

The SEC first filed its complaint against Telegram in October 2019, after it failed to register its early sale of $1.7 billion in "Grams" tokens.

Chinese Authorities Arrest Over 100 People for Involvement in the PlusToken Ponzi Scheme

On July 31, Chinese authorities arrested 109 people suspected of involvement in the PlusToken cryptocurrency fraud ring. The South Korean Ponzi scheme was advertised as a high-yield investment for crypto traders, with the company claiming investors would achieve 9% to 18% monthly returns.

Members were encouraged to bring others into the fold in exchange for a commission, creating a Ponzi scheme of massive proportions. Last year, the operators of PlusToken performed a suspected exit from their scam, in which roughly $3 billion was withdrawn from the accounts of up to four million users who suddenly found themselves unable to access their funds. The Chinese Ministry of Public Security says that they have 27 "major criminal suspects" and a further 82 "key" members of PlusToken in police custody.

As this case keeps unfolding, the real scope of the financial damage continues to come to light. The original estimate of the amount stolen was $3 billion, but Chinese media outlet Chain News now suggests that $6 billion was stolen from investors. This news comes after similar events have unfolded in the UK, where authorities recently closed down cryptocurrency scam platform GPay Ltd. The UK High Court ordered GPay to pay for the loss of £1.5 million ($1.8m) in investor funds.

US Prosecutors Attempt to Return $6.5 Million in Crypto to Victims of Ponzi Scam

US prosecutors are attempting to return $6.5 million in cryptocurrency that was taken from the victims of the "Banana.Fund" crowdfunding project—an alleged Ponzi scheme.

The official report did not identify the operator of Banana.Fund by name. However, several victims of the alleged scam have testified that the fund was run by a British national named Richard Matthew John O'Neill aka "Jo Cook."

Federal prosecutors have accused Banana.Fund's administrator of admitting to investors his project had flopped, promising to return $1.7 million, and then failing to do so. Prosecutors allege that the admin then secretly began a laundering and refund scheme that resulted in the US Secret Service's (USSS) seizure of 482 bitcoin (BTC) and 1,721,868 tether (USDT).

The lawsuit, filed July 29 in the US District Court for the District of Columbia, aims to give the federal government ownership of the assets so they can be returned to the victims.

The way cryptocurrencies are treated in the judicial system can reveal the direction of the law's treatment of cryptocurrencies moving forward. As governments find ways to return stolen or scammed funds to their rightful owners, the repercussions will be felt far beyond the confines of this particular case.

Centra Tech Inc. Co-Founder Implicated in $25 Million Scam

On July 13, Sohrab "Sam" Sharma, the co-founder of Centra Tech Inc., officially changed his plea to guilty for his involvement in a scam that stole more than $25 million from investors through an Initial Coin Offering (ICO) that his company promoted with the help of celebrities, including boxer Floyd Mayweather and musician DJ Khaled.

Robert Farkas and Raymond Trapani, Centra Tech's other co-founders, have already pleaded guilty to the charges that they lied to investors about having developed "Centra Card"—a purported debit card that allowed customers to use crypto to make Visa- and Mastercard-backed purchases.

The trio is also accused of having falsely claimed that they had a Harvard-educated CEO with more than 20 years of business experience, partnerships with large companies including MasterCard and Visa, and licenses in more than 38 states. Prosecutors allege that they touted these falsehoods to solicit investors to pour more money into the fraudulent Centra Token scam.

$15 Million in Crypto and Supercars Seized as Chinese Police Bust Arbitrage Scam

On July 9, China's Ministry of Public Security announced they had seized over $15 million in crypto, and supercars worth an additional $2 million, from the alleged operators of a novel scam that sold counterfeit tokens. This operation resulted in the arrests of ten individuals suspected of operating the fraudulent scheme.

According to the ministry, this is the first reported criminal case in China where victims were allegedly scammed using blockchain smart contracts to generate fake cryptocurrencies. The case was first reported to the police in April 2020 by a victim, identified as Li, who had joined a Telegram group called "Huobi Global Arbitrage HT Chinese Community."

According to Li, the group advertised a blockchain smart contract that supposedly generated Huobi Tokens (HT) that could yield an arbitrage opportunity with a return of 8%. Li explained how the smart contract worked: "Simply put, you send one unit of ETH to a designated address, you will receive 60 HT. And then you can sell it to gain the difference." However, after Li sent 10 ETH to the ethereum address provided by the Telegram group's administrator, the 600 HT he received in return were fake tokens which could not be deposited for selling.

Police Arrest BitGrail Boss for His Role in Largest Cyber-Financial Attack in Italy

The man who ran Italian-based cryptocurrency exchange BitGrail was arrested for allegedly defrauding more than 230,000 people of €120 million ($146 million) collectively. In what was deemed "the biggest cyber-financial attack in Italy and one of the biggest in the world," the BitGrail boss faced charges of computer fraud, fraudulent bankruptcy, and money laundering.

In 2018, the same man alerted police of a Nano Coin hack, communicating the loss of "a huge sum." Ivano Gabrielli, who is the head of the National Centre for Cyber Crimes in Italy, said that when their team started investigating, it became clear that the man was actually the head of BitGrail "[and] it…[was]…not yet clear whether he participated actively in the theft or if he simply decided not to increase security measures after discovering it."

The police further allege that the man, a 34-year-old known as "F.F.," interfered to prevent them from halting the continuing theft.

Promoter of Australian Cryptocurrency Lending Scheme Sentenced to 20 Years

John Bigatton, an Australian man who worked as a promoter for cryptocurrency lending scheme BitConnect, was charged by the Australian Securities and Investments Commission (ASIC) and sentenced to a maximum of two ten-year terms in prison. Bigatton was found to be operating an unregistered managed investment scheme that gave unlicensed financial services and lied to customers by providing misleading financial statements. At one point during the height of ICO mania, the BitConnect pyramid scheme was valued at over $2.5 billion.

Prior to Bigatton's sentencing, the ASIC in September banned Bigatton from providing financial services. In addition to his prison sentence, Bigatton will also have to pay restitution of at least $80K in Australian currency (US$58.5K).

Investment schemes like BitConnect were rampant at the height of the 2017 cryptocurrency bull market, which may hold lessons for the nascent DeFi sector. By the end of 2019, the total locked value in DeFi was less than $1 billion. Total locked value is by the end of 2020 was over $19.8 billion, inspiring comparisons to the 2017 cryptocurrency bubble. Those looking to "get rich quick" by launching a DeFi protocol without taking proper security audit measures shouldn't forget 2017. As the BitConnect case illustrates, the perpetrators of fraud and negligence are still being charged.

The US Department of Justice Seized $24 Million from a Brazilian Cryptocurrency Investment Scheme

On November 4, the US Department of Justice (DOJ) announced that "Operation Egypto," the code name used for the joint U.S.-Brazilian effort to recover funds stolen from a cryptocurrency fraud scheme, resulted in the seizure of $24 million. Brazil reached out to the United States for help in the investigation, as the scheme targeted U.S. residents, among others, by encouraging them to invest in fake investment opportunities that involved depositing either Brazilian currency or cryptocurrency in accounts controlled by the perpetrators.

According to the DOJ press release, Marcos Antonio Fagundes, the mastermind behind the scheme, was charged with "illegal operation of a financial institution, fraudulent management of a financial institution, misappropriation, violation of securities law, and money laundering." Brazilian investigators say that the money that has been recovered will be returned to the victims.

Ilia Kolochenko, the founder of Immuniweb, a Swiss AI Online Protection Program, mentioned that for crimes like these, it is of utmost importance that multiple countries get involved so that the scheme does not have a viral effect, taking off across the web.

IRS Calls Sentencing of Ukrainian National the First Case of Bitcoin Tax Fraud in US

On November 9, the US Department of Justice (DOJ) announced that a 26-year-old Ukrainian national residing in Washington was sentenced to nine years in prison in what the IRS calls the United States' "first Bitcoin case [with] a tax component."

Volodymr Kvashuk is a former Microsoft employee who allegedly stole more than $10 million from the company in currency stored value (CSV) such as digital gift cards. According to Cointelegraph, Kvashuk "used the accounts and identities of his fellow employees to steal and then sell the CSV — making it appear as though his co-workers were responsible for the fraud."

Kvashuk attempted to hide the source of the stolen value by using a Bitcoin mixing service and then communicating to the IRS that $2.8 million in crypto assets flagged as passing through his accounts had been a gift from a relative. He filed a fake tax form to back up the false claim.

OKEx Founder "Star" Xu is Being Held in Police Custody

On October 16, Chinese news sources reported OKEx founder Mingxing "Star" Xu was being held in police custody. Xu's cryptocurrency exchange is headquartered in Hong Kong but is licensed in Malta, creating some ambiguity around where the arrest occurred.

The news followed on the heels of a report that OKEx had suspended cryptocurrency withdrawals due to the absence of one of the exchange's private key holders—presumably Xu —though a report from Mars Finance suggests otherwise. The Mars Finance report suggested that Xu may be being held by police to assist with an investigation into the backdoor listing of OK Group, completely separate from the exchange's halting of withdrawals.

OKEx CEO and co-founder Jay Hao stated that "the issue is over a personal matter and wouldn't affect the business." An OKEx statement sought to assure users of Xu's distance from OKEx, asserting that his involvement was more recently focused on the separate entities of OK Group and OK Coin.

Poor transparency and jurisdiction shopping conspire to increase risk to traders, beyond the volatility of the underlying virtual asset. OKEx appears to be in Malta, a well-regulated jurisdiction, but according to their Terms of Service, non-Maltese and non-Italian clients are serviced through a Seychelles subsidiary, Aux Cayes. Outside of Malta and Italy, Aux Cayes offers riskier financial products, including margin lending, peer-to-peer matching, spot services, and derivative products linked to VFAs or indices.

Global Cryptocurrency Money-Laundering Cartel Busted—20 Arrested

Law enforcement agencies from 16 countries collaborated on a major crackdown in October, making 33 arrests of criminals involved with cryptocurrency money laundering. Twenty of these arrests were suspected members of the QQAAZZ criminal network, which has allegedly laundered tens of millions of dollars for cybercriminals since 2016.

According to Cointelegraph, "[the] funds are allegedly transferred through international bank accounts, shell companies based in Poland and Bulgaria, and via cryptocurrency mixing services." To make the arrests, authorities searched more than 40 homes across Europe and seized bitcoin mining equipment in Bulgaria.

On the same day in a separate case, a New Zealand man was arrested for laundering $2 million in cryptocurrencies, in part through the purchase of luxury vehicles including a Lamborghini and a Mercedes G63.

On October 15, the US Department of Justice unsealed a superseding indictment, which detailed a case against six individuals for conspiring to "launder millions of dollars of drug proceeds on behalf of foreign cartels." Casinos, front companies, cash smuggling, and bank accounts were all used to launder the funds, with one individual using cryptocurrency to bribe a US Department of State official in an attempt to acquire fraudulent US passports.

Money laundering is as old as currency itself. As criminals increasingly look to cryptocurrency to hide the origins of illicit funds, it will be that much more important for law enforcement and investigative agencies to leverage cryptocurrency tracing services and blockchain analytics. "Following the money" generally leads to the source.

Bitcoin Escrow Company CEO Pleads Guilty to Fraud and Embezzlement

On October 1, Jon Barry Thompson, the head of New York-based bitcoin escrow company Volantis, pled guilty to fraud and embezzlement of over $7 million in investor funds. In court documents acquired by CoinDesk, Thompson admitted to misrepresenting Volantis's bitcoin custody, control, purchasing practices, and risk exposure to secure investor funds. Thompson could face a maximum 60-year prison term. His sentencing was scheduled for January 7, 2021.

Thompson also settled with the Commodity Futures Trading Commission (CFTC), agreeing to pay $7.4 million in restitution as well as being barred from all future bitcoin trading and promising full cooperation in any future CFTC investigations.

Crypto Trader Charged with Fraud and Ordered to Repay Over $6 Million to Investors

Thomas J. Gity, a Florida man running a digital assets day trading company, was charged with fraud and embezzlement of over $6 million from investors. The SEC complaint, dated September 29, alleged that Gity defrauded investors of $6.8 million from January 2018 through January 2019 by promoting the false representation that "he was a highly-profitable digital asset trader and had never lost money during a trading day."

Gity used this lie, along with promises of huge returns, to lure in over 18 investors to his operation. He also asserted that he had $100 million under management. The SEC alleges that Gity used the majority of investor funds to perpetuate his Ponzi-like scheme, while funneling about $1.8 million to his son.

Coincheck Hack Proceeds Seized in Japan's First Official Seizure of Cryptocurrency

On August 19, the Tokyo District Court issued an order of seizure for a portion of misappropriated funds that were stolen from the Tokyo-based crypto exchange Coincheck.

In 2018, Coincheck was hacked and over $500 million in NEM (XEM) was stolen by the perpetrators of the attack. At the time, it was one of the biggest crypto hacks yet. However, since then, the value of XEM tokens has dropped by 93%. The original sum is now estimated to be worth around $39 million.

Reportedly, the court issued an order of seizure from Takayoshi Doi, an Obihiro City doctor. Doi is not suspected of being involved in the 2018 hack; however, he was charged for his purchase of XEM originating from the hack.

This action marked the first time that a Japanese court ordered the seizure of cryptocurrency. The funds in question amount to roughly 4.8 million yen ($45,000) in both XEM and bitcoin. Doi is expected to keep the funds safe until an official verdict is handed down.

Justice Department Charges Airbit Founders with Cryptocurrency Mining Fraud

On August 18, The U.S. Department of Justice released an indictment charging the operators of AirBit for international fraud, money laundering, and defrauding individuals through a purported cryptocurrency company.

The five founders of AirBit Club—Pablo Rodriguez, Gutemberg Dos Santos, Scott Hughes, Cecilia Millan and Jackie Aguilar—had been running the company since the beginning of 2015. Airbit was advertised as a cryptocurrency mining and trading company according to the Justice Department.

Victims interviewed about the scam testified that they were under the impression that they had profited when viewing their accounts on the Airbit website; however, these profits were nonexistent in reality. Instead, the operators of Airbit were using those funds to pay for their extravagant lifestyles. The Justice Department alleged that the group is also involved in the laundering of at least $20 million of the proceeds from the scheme.

Malaysian Authorities Arrest Crypto Miners That Stole $600K+ in Electricity

On September 1, Malaysian state officials put an end to a three-year-long crypto mining operation that had stolen more than $600,000 worth of electricity.

"We found that illegal wiring was installed so that electricity was supplied directly and not through the TNB meter," said Nazlin Alim Sadikhi, a regional director with the country's Energy Commission.

Sadikhi explained that the group's largest crypto mining rigs consisted of over 100 individual mining devices and had been operating nonstop for three years. The perpetrators of this scheme only paid $7 to $14 monthly for electricity but consumed over $20,000 worth of power per month.

OCC Hit s New York Based Bank with First-Ever Enforcement Action for Lack of Crypto AML Compliance

On January 30, 2020, the Office of the Comptroller of the Currency (OCC) issued the first cryptocurrency-related enforcement action against New York's M.Y. Safra Bank (MYSB)—the first-ever enforcement action against a US-based bank. The OCC alleged that, for more than two years, MYSB failed to fully vet its cryptocurrency customers and transactions in high-risk jurisdictions.

The order was wholly focused on deficient anti-money laundering (AML) practices for compliance and monitoring of the bank's Digital Asset Customers (DACs). The lack of AML controls cited include opening accounts for DACs without sufficient customer due diligence (CDD) and a lack of adequate monitoring and investigating of suspicious transactions linked to these customers. The entities included cryptocurrency exchanges, bitcoin ATM operators, ICOs, incubators, and virtual OTCs as well as other crypto-related businesses.

Read more details on the CipherTrace blog: https://ciphertrace.com/occ-hits-new-york-based-bank-with-first-ever-enforcement-action-for-lack-of-crypto-aml-compliance/

Major Thefts, Scams, and Fraud